Gifts made to the Howe Library Corporation, a 501(c)(3) nonprofit, are tax deductible and serve as the primary funding source for the Howe Library’s collections and programs.

Howe Annual Fund – Individuals & Businesses

One-Time Gifts

Monthly Giving Program

Join the Howe Sustainers Circle by making an automatic monthly contribution using your credit card. As a monthly donor, you provide steady support for library services.

Qualified Charitable Distributions

You can make a gift directly from your IRA to the library, which is called a qualified charitable distribution (QCD):

- If you are age 72 or older, under current IRS rules, you must take a required minimum distribution (RMD) from your IRA each year.

- If your RMD is paid directly to the library, you satisfy your RMD and support the library!

- You avoid income taxes on your RMD.

- You can make a gift up to $100,000 from your IRA each year.

Please consult with an investment advisor or tax professional to determine if a QCD is right for you.

Gifts of Securities

Gifts of securities are an easy way to support the library while also providing a tax benefit to you. With this contribution, you may avoid paying capital gains taxes that would have applied had you sold the shares yourself. Transfer instructions are here.

Community Sponsorship Program

Businesses and organizations are invited to donate as part of the Community Sponsorship Program. Community Sponsors support library services while receiving recognition throughout the year. A list of benefits can be found here. Please email Peggy Bellerive at howetogive@thehowe.org for more information.

Endowment & Gift Planning

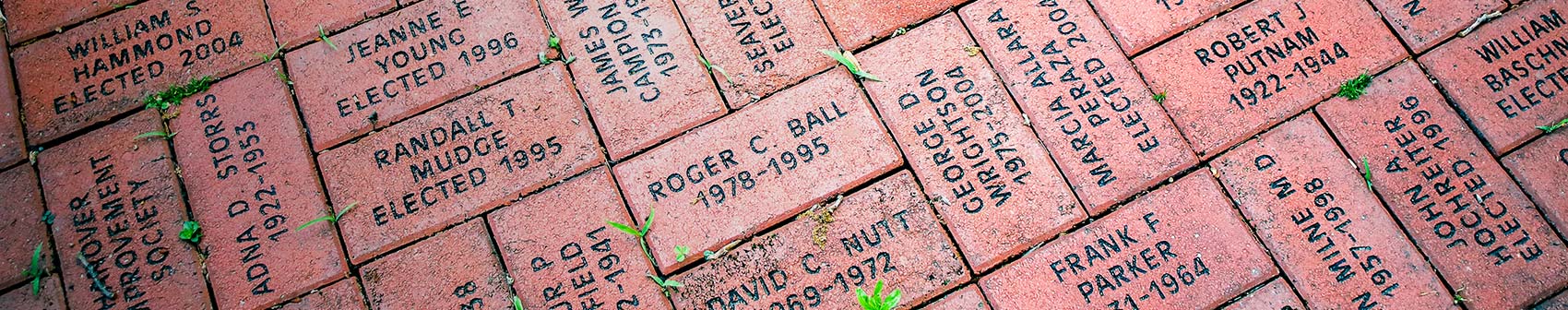

Endowment Gifts

Donations to the Howe Library Corporation’s Endowment help fund library services and strengthen our long-term financial security. Unrestricted gifts of any amount are welcome and deeply appreciated! If you are interested in creating a named or restricted fund, please email Peggy Bellerive at howetogive@thehowe.org to schedule a conversation.

Emily’s Legacy Society

Emily’s Legacy Society was formed in 1912 with a gift from Emily Howe. You can join these generous individuals by naming the Howe Library Corporation in your will or estate plans with a simple bequest or as a beneficiary of your life insurance, retirement plan, or IRA. Please notify us when you update your estate plans so we can recognize you (with your permission) and plan for the future. Please email Peggy Bellerive at howetogive@thehowe.org for more information.